Investor Resources

Manage Your Commercial Property Investments With a Partner

The commercial real estate sector offers a wealth of opportunities, but success in this arena requires a comprehensive understanding and a trusted partner.

In this blog, we'll explore what it means to invest in commercial properties, discuss the key benefits of doing so, and introduce you to our company, Kenwood Management Company.

With decades of experience in the Washington D.C. and Baltimore metropolitan submarkets, we are your trusted partner for profitable real estate investments.

So, keep reading to learn how our experts at Kenwood can help you and tips on how to invest in real estate with a partner.

Understanding the Commercial Real Estate Landscape

With a deep knowledge of the commercial real estate landscape, one can reap its many rewards — provided they have an experienced guide. This sector offers significant benefits, but you need to navigate it with an informed understanding and a trusted partner.

What Is Commercial Real Estate Investment?

Commercial real estate (CRE) investment refers to buying property used solely for business purposes.

It includes retail buildings, office spaces, warehouses, and more. The aim is to profit from either rental income or capital gain. However, this isn't a simple process — investing in CRE requires thorough research and careful decision-making.

In addition to choosing the ideal commercial property investment, investors must consider factors like location and market trends when making their choices.

What Are the Key Benefits of Investing in Commercial Real Estate?

Diving into CRE investments can offer impressive returns if done correctly. For starters, compared to other forms of investments, such as stocks or bonds, properties often provide more stability.

Apart from generating steady cash flow through rents or leases, a well-chosen property may appreciate over time, giving rise to substantial capital gains. There are also tax advantages — deductions on mortgage interest, costs, and depreciation can help boost your bottom line.

To maximize these benefits, it helps to have experienced hands guiding you. That’s where Kenwood Management Company comes into play. We are seasoned in navigating the CRE landscape and can help you avoid common pitfalls while amplifying your returns.

Investing in Commercial Real Estate with a Trusted Partner: A Step-by-Step Guide

Beginning your commercial real estate investment partnership might seem intimidating. However, there is no need to worry. With Kenwood by your side, you can navigate this process easily.

Let's take you through the process.

Step 1: Identifying Investment Objectives

The initial move is to decide what you desire from your investments. Is it steady cash flow? Capital appreciation? Or maybe a mix of both?

This understanding will shape your investment strategy and guide our team at Kenwood to help you make smart decisions tailored to those objectives.

Step 2: Portfolio Diversification

You've probably heard this before - "Don't put all eggs in one basket." The same goes for property investing too.

Diversifying across different types of properties like office buildings, retail spaces or industrial units can provide more stable returns as they are affected differently by market conditions.

Step 3: Risk Management

No investment comes without risks, but that doesn’t mean we let them catch us off-guard.

We help identify potential challenges and work proactively to mitigate these risks through careful selection and diligent management practices.

Step 4: Property Selection

Selecting the right property isn’t just about location; It’s also about identifying opportunities that align with your financial goals and risk tolerance.

This involves rigorous research & analysis which our expert team at Kenwood has honed over decades in the business.

Step 5: Ongoing Management And Optimization

Once a property is acquired, our team of experts at Kenwood never stops working to ensure you are always one step ahead in the commercial real estate investment market.

We keep a keen eye on market trends and continually optimize strategies for each property. This ensures you are always one step ahead in commercial real estate investment.

Meet Kenwood Management Company

Navigating commercial investment requires an experienced real estate partner to help guide you toward successful outcomes. That's why our team at Kenwood Management Company is here to help you. We specialize in the Washington D.C. and Baltimore metropolitan submarkets.

Instead of merely providing space, Kenwood aims to build thriving business environments where companies can prosper.

Company Overview

In over three decades, Kenwood has honed its expertise in managing properties across industrial, flex/warehouse, office buildings, and retail centers. Our portfolio boasts more than two million square feet under management with a tenant retention rate exceeding national averages.

Our accomplishment isn't a fluke; it comes from consistent hard work and an approach that emphasizes long-term progress instead of momentary advantages.

Our Commitment to Excellence

A big part of why Kenwood stands out lies in our unwavering commitment to excellence, which translates into superior service delivery at every level.

This begins with property acquisition, where careful due diligence ensures the selection of high-potential assets offering attractive returns for investors.

To ensure tenants get the optimal value, responsive property management strategies address everything from maintenance issues to promptly fixing them before they escalate into significant headaches while optimizing operations for increased efficiency.

The Power of Informed Decision-Making

The Power of Informed Decision-Making

Knowledge is power. In commercial real estate investing, informed choices are the source of success.

Let's examine why this is accurate.

Research and Due Diligence: The Cornerstones of Success

Due diligence means doing your homework before moving on to an investment property. This includes reviewing financial statements, assessing potential risks or problems with the property, and checking out the surrounding market conditions.

A solid research process allows you to uncover all necessary details about prospective properties — from tenant histories to future growth projections for their location. When it comes to investing success, it’s often these finer points that can make or break a deal.

Working with Kenwood Management: Finding Your Investment Potential

When working with Kenwood Management Company, investors gain access not only to premium properties but also to our team's extensive experience and knowledge base.

We have honed our due diligence methods over decades, refining them into a precise system designed specifically for maximizing return potentials while minimizing risk exposure.

-

Finding Ideal Properties: We help investors find opportunities they might otherwise overlook by keeping abreast of emerging markets and using data-driven strategies tailored toward individual investor needs.

-

Negotiating Deals: Our team has years under their belts successfully negotiating lease terms that are both favorable for tenants and profitable for owners.

-

Effective Management: We use our industry knowledge and connections to keep properties running smoothly, addressing maintenance issues promptly and ensuring tenant satisfaction.

Every successful investment begins with an informed decision and our seasoned professionals at Kenwood can help you make those decisions.

Historic Returns: Kenwood's Success Stories

Allow us to examine our remarkable success stories.

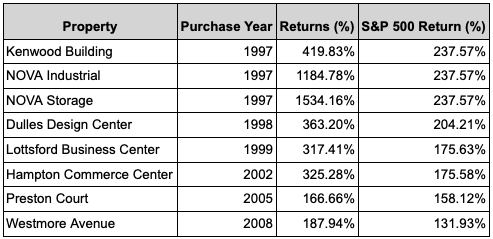

Our first-ever acquisition was the Kenwood Building back in 1996. Investors have received all their initial equity back plus approximately three times their initial investment from excess cash flow and refinances.

Compared with other financial indices like the S&P 500, our returns are more than just impressive—they’re record-breaking. To put this into perspective, Let us examine some quantifiable data to gain valuable insights.

These numbers tell a story of continuous growth and outstanding returns, showing the strength of Kenwood's investment strategy.

We Want the Best For Our Clients

At Kenwood, we strongly prioritize customer service in our daily tenant interactions. Our commitment to exceptional service becomes even more crucial as we aim to create long-lasting relationships with our tenants.

We go the extra mile by providing additional building engineering and HVAC services. Our dedicated team of experts ensures optimum performance, efficiency, and comfort for your space.

During the COVID-19 crisis, we worked with our tenants facing financial challenges. We devised pragmatic rental structures and lease terms to ensure the survival of their businesses.

Rather than impeding their progress, we sought practical solutions to a crisis that may have caught many off guard and for which they might not have been adequately prepared.

We also seek ways to support our tenants' businesses by organizing events with renowned guest speakers and facilitating introductions to potential new business opportunities.

Invest With a Trusted Partner in Washington DC Commercial Real Estate

Investing in real estate is a profitable opportunity, but it requires careful consideration and deliberation.

At Kenwood, we understand the complexity of the process and provide comprehensive services that support our clients throughout the journey. From market analysis to ongoing management and optimization, our team ensures that your investments are certain to yield positive returns.

We are committed to providing the highest level of service and expertise to ensure our client's investments reach their full potential. Our team takes a proactive approach to management, leveraging cutting-edge analytics tools and best practices to create customized solutions for each property.

Our team at Kenwood is here to provide you with the guidance you need to be successful in the commercial real estate market. If you want to begin building your knowledge with us, download our comprehensive guide, How to Invest in Commercial Real Estate.